Tuesday, September 22, 2015

The Ultimate Shorthand Guide

Understanding all of the technicalities of investment — how you shouldcalculate your valuation, what your term sheet actually says, and what a cap table is, let alone should demonstrate — can an often feel like the most difficult part of the process. Even more than pitching and finding the right investors, understanding the technicalities of investment requires learning and applying what is likely completely new information. But just because something like reading or building a cap table is new or unfamiliar doesn’t mean it’s inherently difficult.

A capitalization table, at least in theory, is pretty simple to understand. It’s an actual table that takes all of the shareholders in your business and lays out who owns what, how much each one owns, and what value is assigned to the stock they do own.

Cap tables are extremely important for a number of reasons, but one of their most important functions is that they allow investors to understand what they’re buying, as well as help all of the shareholders (yourself included) keep track of their stake as your startup raises more capital.

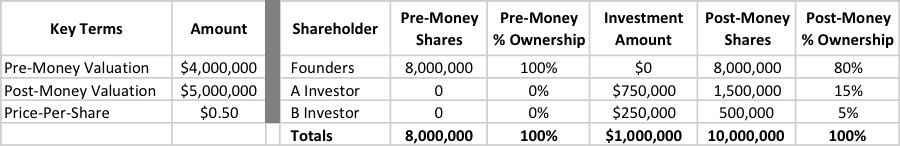

Let’s take a look at a cap table and what it actually shows.

In this simple example, you can see all the key elements of the table: post-money valuation, price-per-share, shareholders, how much shareholders paid for shares, and what percentage of ownership it gives them pre and post-money.

Let’s break this down into its core components to see where these numbers came from, starting with post-money valuation.

During your term sheet discussions with an investor you will have agreed to a pre-money valuation and how much money will be raised, which added together will equal post-money valuation. So with the example above, the post-money valuation equals $5,000,000 because:

$4,000,000 + $750,000 + $250,000 = $5,000,000

The other item that is automatically calculated during the term sheet discussions once a pre-money valuation has been agreed upon is price-per-share, which determines how much the investor will pay for shares. The price-per-share is simply the pre-money valuation divided by the number of pre-money shares:

$4,000,000/8,000,000 = $0.50

The number of investor shares comes from dividing the total investment amount the investors put in by the price-per-share. So total investor shares would equal:

$1,000,000/0.50 = 2,000,000

Investor A shares would amount to:

$750,000/0.50 = 1,500,000

And finally, Investor B’s shares would amount:

$250,000/0.50 = 500,000

Investor percent ownership is calculated by taking the investor shares from above and dividing them by the post-money shares. In this case, Investor A’s percent ownership would be calculated as:

1,500,000/10,000,000 = 15%

And Investor B’s percent ownership would be:

500,000/10,000,000 = 5%

All of the key terms on a cap-table build from one another and are driven primarily from the term sheet discussions. But to sum up, you’ll be using all of the below formulas.

Post-Money Valuation = Pre-Money Valuation + Total Investment Amount

Price-Per-Share = Pre-Money Valuation / Pre-Money Shares

Post-Money Shares = Total Investment Amount / Price-Per-Share

Investor Percent Ownership = Investor Shares / Post-Money Shares

Price-Per-Share = Pre-Money Valuation / Pre-Money Shares

Post-Money Shares = Total Investment Amount / Price-Per-Share

Investor Percent Ownership = Investor Shares / Post-Money Shares

As you continue raising capital and involving more and more investors, your cap table may start becoming messier and harder to quickly understand. More importantly, as you enter into new agreements with investors that involve different liquidation preferences and different values assigned to your equity, how much you own and how much you control will change.

This post is part of the Hyde Park Angels Entrepreneurial Education Series, which brings together successful, influential entrepreneurs and investors to teach entrepreneurs everything they need to know about early-stage investment through events, articles, videos, and more. If you are interested in learning more about similar topics, register for “Connecting Corporations and Startups” on September 24.

Source: Alida Miranda & Michael Sachaj, Authors, www.medium.com

Subscribe to:

Post Comments (Atom)

Search

Powered by Helplogger

Popular Posts

-

As consumer companies continue to expand their global presence, they face a host of formidable challenges: among them, staying clos...

-

In the past few years, the business focus on entrepreneurship and start ups has increased. What exactly does it take to be an entrepren...

-

We all know the importance of Time Management. Without it, not only will things fall out of place but it will be a burden on one's sel...

-

Many companies are reorganizing to cope with new competitive realities, but few CEOs have approached the process of organizational red...

-

Warren Buffet Research and anecdote teaches that wealthy people, including the very wealthiest, are surprisingly frugal. That’s not sa...

-

In 2011, Lavinie Thiruchelvam (a law graduate who worked at ABN Amro and founded Dance Space) started Babydash with her friend from se...

-

"What is this Nurture Growth Conference about?", you ask. There are so many seminars about Getting Wealthy by the age of 30, or ...

-

It was easy to forget about the difficulties of building my business, Brooklyn Taco Co., when I was catering for The Daily Show with ...

-

As the old adage goes: “You’re only as good as the people around you.” While it’s true in both life and business, it’s certainly magn...

Blog Archive

-

▼

2015

(71)

-

▼

September

(23)

- 6 Gorgeous Content Marketing Ideas for Small Business

- Business Analytics 101 – Budgeting, Planning and F...

- Time Management 101: Stop Managing Time

- The Independents: VLT by Warren Tan

- 5 Essentials of Small Business Investing

- Sizing Up a Franchise in Six Steps

- How to Read and Understand a Cap Table?

- How to Manage Time With 10 Tips That Work

- VIDEO: The #Blogging Business with #TimothyTiah, C...

- How Do you Analyze Your #Website Audience In #Goog...

- 5 Ways #Entrepreneurs Screw up the #Hiring Process

- #Financing and Managing Your #Event – The Must Knows

- 30 #TimeManagement Tips For #Work-Life Balance

- What makes #JoelNeoh of #Groupon tick?

- Importance of #Sales & #Marketing

- The 4 Types of Mentors You Need in Your Life to Su...

- Drafting Your #Budget

- 10 Simple Productivity Tips for Organizing Your Wo...

- Entrepreneur Interview: Alex Tsigutkin, Founder An...

- Market to the Best Leads

- How Good is Your #TimeManagement?

- 6 Tips to Hire THE BEST Start-up Leadership

- 10 Ways to Finance Your Business

-

▼

September

(23)

About Best Events

Powered by Blogger.

0 comments:

Post a Comment