Wednesday, September 30, 2015

Unlike direct-response advertising, which explicitly aims to sell a product, content marketing sets out to sell consumers on the brand behind the product. If you’re a small business owner, posting valuable, entertaining or inspirational content reflects positively on your brand. When a piece of content gets lots of social media shares and likes, the brand behind it instantly wins attention, extra credibility and a big crowd cheer. Sounds good? Here are 6 content marketing ideas you can add to your marketing calendar.

Take people behind the scenes

Offering a glimpse into the nuts and bolts of your business can help people connect with and feel loyal to your brand. You can use a video or photos to help potential customers learn more about your products, how they are made or who makes them. Or you can simply shoot some fun footage presenting a typical day at the office.

Videos are easy to make – you can do it with your iPhone – and when you post them on YouTube and other social networks with a few lines about your business, they can increase the chances that customers will find you on Google.

When Wix produced its first ever Super Bowl commercial in 2015, we took fans behind the scenes with this fun video about how the commercial was made.

Profile your staff

Telling people about your fun, interesting and very-real staff members reminds customers that behind every business are men, women (and puppies) just like themselves. You can share videos, personal stories or simply staff bios. Choose language and a tone that represents your brand, but don’t be afraid to be funny and creative. Offer your employees the freedom to present their unique personalities.

The SEO geniuses at Moz.com give each of their staff members a chance to express themselves on an individual page. Nice touch.

Share user success stories

User success stories are like a beefed up testimonials page. Rather than a brief, 2-sentence endorsement from a past customer, you can ask loyal clients to share a story about your product and service, how it impacted their lives or why they where happy with the purchase. Then, you can present the stories on video, in photographs or as a blog and post them on your website and social media.

Here at Wix, we created Wix Stories as a place where our users can share their personal experiences working with Wix. Stories can inspire creative uses of your product and also help reassure a hesitant client that your company and products are reliable.

Write a blog

Blogs are one of the best ways to regularly generate great content about your business. You can write posts that demonstrate your expertise, share insights into how your products are made and help customers get to know your company and employees.

To write a blog that people will want to read, think about how you can provide your customers with helpful information or interesting stories. Good blogs don’t just market a company’s products; they provide added value for the reader.

Finally, remember that blogs aren’t just about writing! You can also upload photos and videos in your blog. Don’t forget to share each post in social media. And we don’t just mean Facebook. You can find lots of readers in LinkedIn groups, in a newsletter to your customers or in a guest post on a popular blog site in your industry.

Feature a “How To” video

Find the right topic and your homemade “how-to” video can go viral. A simple video that shows people how to do something commonplace, but related to your product, can be a great way to promote your company and gain exposure.

This amateur video about “how to fold a fitted sheet” racked up more than 11 million views and undoubtedly brought in a significant increase in traffic to the website that produced it.

From “how to eat a cupcake” to “how to take a screenshot with your Galaxy s4” the sky’s the limit when it comes to thinking of topics that you can film. Find one relevant for your industry and give it a shot!

Publish an ebook

The advantage of living in today’s world is that anyone with Internet access can publish a book. You don’t need to get a publisher to back you to distribute your writing to readers in any corner of the world. If you love what you do and want to share it with others, or if you have unique skills that others might want to learn, consider writing an ebook.

It’s much easier than you might think and can do wonders for raising awareness about your business. We’re not talking about War and Peace, either. Some of the best e-books are short manuals jam-packed with helpful photos, so don’t be daunted if you think an e-book needs to be 100+ pages.

Want to give it a try? Be sure to check out our blog for tips on how to write an e-book that sells like crazy (and does wonders for your business).

Good content marketing is invaluable to the success of your business. Done well, it can establish you as an expert in your field, help your business get found on Google searches and set you apart from competitors. Try out some of these ideas above and share your own experience in the comments below!

Source : Anonymous, 2015, www.wix.com

Tuesday, September 29, 2015

With the exception of the occasional James Bond movie that proves the rule, we don’t as a matter of course combine our modes of transportation into one all-purpose vehicle. But when it comes to financial management, there is one tool , commonly called the Budget, that gets applied to all problems involving dollar signs.

Before we get into the details of exactly how bad of an idea this actually is, a little structure would be beneficial, coming in the form of this three-tier hierarchy for financial management.

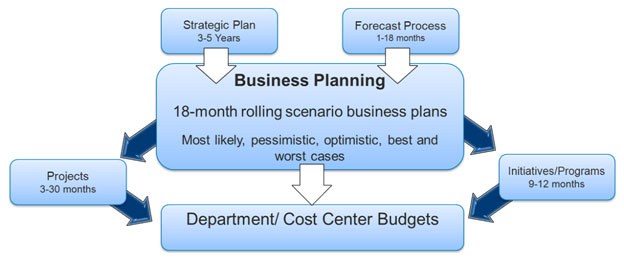

At the top level resides Strategy and the Forecast, or rather, Forecasts, plural, as the enterprise seeks to gain as much information, insight and foresight from as many sources and time horizons as possible, such as 60-day cash collection forecasts from account receivables, 90-day Ops forecasts from ERP, six-month sales forecasts from the field, 9-month staffing and expense forecasts from the functional departments, 1-year product launch forecasts from marketing, and 2-year industry outlooks from the analysts. Forecasting is also typically the primary focus of analytical techniques in the office of finance, with tools such as econometric, regression and trend analysis applied to avoid the gaming of the system, and to improve accuracy and confidence in both the forecast and the resulting decisions.

At the bottom is of course the Budget, the intended output of the whole process. Between these two levels lives the most neglected and under-resourced activity in finance – Planning. Too often we connect the budget directly to the forecast, resulting in reactive knee-jerk responses and half-way measures such as hiring, salary, capital and travel freezes that please no one, not even the CFO who issues them. Or, when the Budget gets too far out of line during the middle of the year, we confound the situation by substituting Variance-to-Budget with Variance-to-Forecast, which merely moves the game playing to a much more detrimental location - you do NOT want games being played with the forecast. Instead, you want the most accurate picture, the best guesses, put forward, unfiltered and unaffected by the current situation or year-end bonuses.

What should drive the Budgets are the Scenarios that result from the planning process; not just the Most-Likely Case, but also the Optimistic, Pessimistic, Best and Worst cases as well.

To drive this point further, consider these definitions that Steve Player shared with us at the recent ABM Smart conference in Charlotte, NC:

- TARGETS: What you’d like to happen

- FORECAST: What you think will happen

- PLANS: What you intend to do

When it comes to the definition of the BUDGET, however, it gets a little messier. Here is just a partial list of what many organizations use the Budget for: Cash planning, Targets and incentives, Investments, Cost understanding, and Resource management. I will submit to you that the use of the Budget should be limited to just that last item – Resource management and allocation, and reallocation, and reallocation, as conditions change, which they always do, and not always in neat 12-month segments aligned with the Gregorian calendar.

The first usage you want to decouple from the Budget are targets and incentives. You cannot be an agile organization, reacting quickly to opportunities and challenges if in order to implement a revised budget you must also renegotiate the associated bonus schemes at all levels across the organization. Targets and incentives are best managed through the use of a Balance Scorecard, where they can be tied to inter-related key metrics and to external benchmarks such as growth and market share that better reflect the health and performance of the organization.

In the next case, investment decisions do not naturally reside comfortably at the level of the budget; they are most at home at the intersection of Strategy and Planning. And lastly, variances to Budget do nothing to improve your understanding of Costs, as they assume what remains to be proven – what SHOULD the costs be. For that you need an understanding of the processes and activities which consume the resources, and the ability to benchmark them with best-in-class players in your industry, capabilities provided by an activity-based management system. As for Cash, we all know that cash ends up being the “plug” that makes the balance-sheet balance, and that every organization relies on a more rigorous treasury process to assure adequate supplies of working capital.

So with the removal of targets, investments, costing and cash, you might ask, “So what’s the Budget for?” The answer: Resource Allocation. And re-allocation, and re-allocation, based on ready-to-hand prebuilt scenarios, complete with predetermined triggers and pre-negotiated revised targets. With that division of labor in place, between budgeting, planning and forecasting, you can react quickly to changing conditions, keep operational activities aligned with strategy, and maintain the integrity of your forecasting process. Leave the “all-in-one-size-fits-all” stuff to James Bond.

Source : Leo Sadovy, Contributor, 2011, www.blogs.sas.com

Monday, September 28, 2015

Do you find yourself running at an even more frenzied pace during the holiday season? I do. So, as I looked at my bottomless to-do list and deadlines fast approaching I did a Google search on “time management”. I got 1,610,000,000 search results. Clearly a lot of us are searching for ways to manage time better. As I read through the various tips, I realized that our obsession with managing our calendars has actually resulted in our calendars managing us. I realized that my perspective that I am time-starved is actually stopping me from being effective as a leader.

Many of us are stuck in a perspective that how we manage our time determines how effectively we lead or how effectively we live our lives. Here’s what we’re missing.

The Greek philosophers identified time in two aspects: Chronos (chronological or calendar time) and Kairos (the ever present “now”). “Kairos” according to Wikipedia is defined as “a passing instant when an opening appears which must be driven through with force if success is to be achieved.” In our time-starved perspective we have forgotten about the abundant quality of “kairos”.

If all we manage to is chronological time (i.e. what’s next on the calendar) we actually give up the “kairos” qualities of time that make leading most effective – being fully present to the opportunities in the present moment. There are many things worthy of our time that in our “time-starved” perspective we feel we can never carve out time for. A different perspective to explore is to “carve-in” to our existing time the qualities of being that help us be more effective. Here are some qualities to manage instead of time.

Manage Connection

Our focus on getting to the next meeting or the next task on our to-do list stops us from truly connecting with one another. Being present to what is going on right now with people (teammates, customers, or bosses) allows us to connect at a deeper level with their motivations. Our ability to connect and influence others is a key driver of our leadership.

Manage Stress

Our rush to get our activities accomplished generates stress within us, which leads to more stress around us. Our stress is contagious. The best decisions are made when we manage our stress levels in the present moment. The greatest creativity happens when there is an environment that is supportive rather than stressful. It’s our job as leaders to create that environment.

Manage Focus

In our frenzy to get lots done we believe multitasking is the way to go. Not so. Many studies have shown that multitasking adds to our stress levels. Studies also show that being fully focused on one task without a lot of mental commentary is what also contributes greatly to being happy.

Manage Listening

Often as we listen to others, we have our own internal dialogue or we’re impatiently waiting to speak. The ability to fully listen to the words and underlying emotions of an individual are compromised when our minds are racing because the clock is racing. When we listen openly, people talk. The best decisions are made when all perspectives are heard.

Manage Perspective

Our perspective represents the place we make decisions from and act from. Our perspective is our truth, not necessarily the “Truth” and often comes from past experience. Are we present enough to look at the opportunities in the present moment to shift our perspective so better decisions can be made? Or do we go around with our minds firmly made up in the interest of efficiency and expediency?

So, my goal for myself this holiday season is to stop managing time and start managing all the other qualities that will make me a better leader at work and at home. How about you? Please comment and share your thoughts on the topic.

Source : Henna Inam, Contributor, 2013, www.forbes.com

Friday, September 25, 2015

Respected and known as one of the strongest independent agencies in the Malaysia ad scene, design, technology and innovation agency VLT has no doubt caught the attention of global networks. The agency has also won the Local Hero and other titles at A+M’s Agency of the Year awards across multiple categories.

With a strong revenue sheet, the agency has made a record number of hires in the second quarter of 2015 – totaling 19 new hires as of May this year. The diverse group of new hires consists of content specialists, designers, strategic planners, developers, client service specialists, a product manager and a lawyer.

A+M finds out from Warren Tan, CEO of VLT on what he looks at when building up a team and the hardships of staying independent.

When was the precise moment you knew you wanted to do something on your own?

We didn’t start off as an agency, unlike many of our peers. We evolved over the years, but I had always wanted to be an entrepreneur.

We didn’t start off as an agency, unlike many of our peers. We evolved over the years, but I had always wanted to be an entrepreneur.

I always share this story – my dad did two very important things for me. Firstly, he bought me a computer when I was 12; and secondly, he refused to upgrade it for me, telling me to figure out how to make my own money.

My first business in high school was a used computer parts trading business. This pivoted into servers, then a hosting and technology business, then a design and development business.

Around 15 years later, we now have VLT!

Which year did you first start up? Who was the first client you had on board?

My first proper “company” started in 2000. I can’t remember our first client, but they were friends and fellow geeks from the tech innards of the post-dotcom-boom days of the early internet.

My first proper “company” started in 2000. I can’t remember our first client, but they were friends and fellow geeks from the tech innards of the post-dotcom-boom days of the early internet.

How did you put your first team together?

I started off in my bedroom, and by hiring friends to help me part-time and on a freelance basis. We then eventually had a proper office, and I still remember my first four hires: 3 designers and an all-in-one account manager / project manager / business development executive!

I started off in my bedroom, and by hiring friends to help me part-time and on a freelance basis. We then eventually had a proper office, and I still remember my first four hires: 3 designers and an all-in-one account manager / project manager / business development executive!

It was a really close-knit team.

What was one of the toughest moments in running your agency? How did you overcome it?

Losing our largest client, which accounted for more than 33% of the year’s revenues; and the unavoidable cash flow pinch that followed.

Losing our largest client, which accounted for more than 33% of the year’s revenues; and the unavoidable cash flow pinch that followed.

We were a team of about 20 at that point, and at the townhall to share with everyone the truth about the situation I thought that I would lose everyone and everything we had fought for. But to cut a long story short, we didn’t lose a single employee, had some amazing stories of loyalty and sacrifice, and most of all we actually managed to break even for the year.

I still owe a debt of gratitude to those who battled with us through those days!

Were you afraid of failing? How did you handle it?

I really think I ought to fear failure more, but I guess I’ve always weirdly been an optimist.

I really think I ought to fear failure more, but I guess I’ve always weirdly been an optimist.

Or maybe it is because my partners, team and I have always believed that we’re building something that we truly truly believed in: our purpose, our culture and what we do for our clients is special, and that helps us really just move forwards no matter what.

How does it feel like to be your own boss? Could you ever work for someone else again?

To be honest, I’ve never worked “for someone else”. Having said that, I don’t consider being “boss” any “better” than working for someone else. I’m accountable and answerable to my partners and my team, and that responsibility is truly a heavy one.

To be honest, I’ve never worked “for someone else”. Having said that, I don’t consider being “boss” any “better” than working for someone else. I’m accountable and answerable to my partners and my team, and that responsibility is truly a heavy one.

Pluses and minuses of being independent?Again, I’ve never worked anywhere else and/or known any agency other than my own. I’ve plenty of friends who run network agencies, and whilst they have (or their headquarters have) deeper pockets, resources and reach, I don’t envy their lack of agility, innovation and speed.

VLT has invested in at least half a dozen areas including startups, innovation, the community and even co-working spaces where I believe will give us a significant advantage over our peers in the days to come, especially when the agency model is changing.

When you first started out, how did you market your agency? How did you get clients on board?I’ve been an entrepreneur all my life and the thing I love more than anything else is to build a successful brand, company or product.

Ultimately this is what my team and I have been doing for all of our clients for the last 15 years: applying strategy, design, technology, and more recently, innovation to solving their problems and making them successful in the digital and social age.

Our marketing has remained the same: do great work that works, and let our clients talk about it.

What was your first experience in the ad world? How do you think that shaped you?

Again, never had a job in the “ad world”. I think this has helped me greatly, to look at how things were so broken and unhealthy with ad agencies, and be determined never ever to build it to look like everyone else in the industry.

Again, never had a job in the “ad world”. I think this has helped me greatly, to look at how things were so broken and unhealthy with ad agencies, and be determined never ever to build it to look like everyone else in the industry.

I guess this is why VLT, for better or worse, stands out from the field!

What have you taken away from your years in the ad world and implemented in your current business?Nothing

What is the one thing start-ups need to remember in this market?

Startups to me mean tech startups, and I’ve had the privilege to invest in and mentor plenty.

Startups to me mean tech startups, and I’ve had the privilege to invest in and mentor plenty.

I’d tell them that ideas are worthless, it is the execution and timing of the idea that determines if you succeed or fail. With an agency or creative business, strangely, this piece of advice probably holds true too: plenty of creative jobs are won on the basis of an idea, but most of the fail because of bad execution and a lack of understanding of context and timing with the client, as well as the world!

What is one piece of advice you’d give anyone wanting to make it out on their own?I highly discourage it. Don’t get me wrong – I love entrepreneurs and help many – but it is really really only for those who have an indefatigable belief in what they want to do, and are prepared to sacrifice everything to do it.

This is especially so for an agency business: I’ve built many businesses, but this is definitely the hardest by far. I just returned from a global meeting of the CEOs of SoDA (the Society of Digital Agencies) – the global average margins for our businesses TERRIBLE compared to most other industries. It is incredible difficult to make money here!

Would you be open to buyout?

This is the follow-on joke from the previous question right? At SoDA we independent agencies were just joking that the only way we ever made any money from our businesses were when we sold out…

This is the follow-on joke from the previous question right? At SoDA we independent agencies were just joking that the only way we ever made any money from our businesses were when we sold out…

To answer the question: we’ve been approached quite a few times in the last few years, but so far we haven’t found the right partner. Not in any particular hurry to sell out!

Five year plan for the agency?

We’d have to do a completely different interview to talk through this one! But essentially, I don’t believe that the agency landscape is going to look the same in five years – and we’re certainly not sitting around.

We’d have to do a completely different interview to talk through this one! But essentially, I don’t believe that the agency landscape is going to look the same in five years – and we’re certainly not sitting around.

All our current investments into our Labs unit, startup incubation, community building, events, co-working spaces and the design and technology ecosystem as a whole are designed around our plans for the future.

Founding year: 2000, and again in 2013 as VLT

Founded by: Warren Tan

Claim to fame: winning BMW Malaysia in December 2014 from long-time incumbent LB.

Founded by: Warren Tan

Claim to fame: winning BMW Malaysia in December 2014 from long-time incumbent LB.

Source : Rezwana Manjur, Contributor, 2015, www.marketing-interactive.com

Thursday, September 24, 2015

The most important question for a small business investor is where to focus attention. What makes one company more interesting than another? There are 28 million small businesses in the U.S., but few research services. This provides great opportunities for above-market returns but also means investors must have an approach for determining which companies are worth focusing on. After many years of investing in private companies, I have developed an initial framework–the first five things I look at when I see a new company.

This list is not intended to be all-inclusive; it’s intended only to serve as a starting point. Valuation and deal structure, for example, are critical (likely an entirely separate post). The principles behind this list could apply to many industries, but they are especially relevant to consumer and retail businesses, the industries in which I have the most experience.

1. Gross Margin. Gross margin is the percentage difference between what a product sells for in the market (revenue) and what it costs to produce that product (cost of goods sold, or COGS). This ratio is critical because it is what allows a company to invest in all the other areas needed to get the product to market such as marketing and distribution.

Gross margins can vary by industry, and even by categories within an industry, but razor-thin gross margins leave no room for error. In private equity, I focused on investing in categories that had higher gross margins and thus could sustain increased costs more easily. Examples of higher gross margin categories include personal care, premium pet food, and natural and organic products.

It’s very important to keep in mind that gross margin expansion is very difficult. Focusing on creating products with better margins, automating production or getting lower prices for ingredients can help, but the instances where gross margin improvement drives outsized investment returns are rare.

2. Brand Strength – This is often the toughest thing to assess in a small company, but an investor needs to ask herself, “Does this brand offer something unique?” A great example of this is Method, the eco-friendly cleaning products company (disclosure: Eric Ryan, the CEO of Method, is a friend, and we have a quote from him on CircleUp). The world did not need another green cleaner, yet Method created a special brand by packaging a quality product with beautiful design and distinctive packaging.

Customer/consumer surveys, “earned” media presence, and third-party data are good ways to start evaluating brand strength. In the consumer packaged goods (CPG) world, there are countless energy drinks and cleaning products. But there’s a reason why Red Bull and Method have been huge successes while other products with similar recipes and formulas have failed: formulas can be copied, brands cannot. A tech entrepreneur will not put her idea for a startup on a crowdfunding site (unless all other investors pass), because any engineer can copy it. But a consumer products company with $3 million in revenue would be comfortable talking about not just the idea, but the actual performance of the business. Why? Because you can back into the recipe for Cherry Garcia from Ben and Jerry’s. It doesn’t matter. You can’t copy the brand.

3. CEO – In a small business, you are investing as much in the leadership as you are in the product or company. As a result, you need to invest behind a CEO in whom you believe. As part of your initial diligence, reference checks and third-party background checks are a must. Beyond that, there isn’t a formula for evaluating leadership talent but you should do what every investor does–spend time asking questions. Get on a conference call and probe on issues you think are important. Does this person understand their business, have a passion for the product, and have what it takes to persevere?

4. Exit Prospects – Many people think that if they build a great company there will always be a home for it, but in certain industries that’s not the case. If the company has visions of selling to a strategic acquirer, it should be able to 1) identify who these likely “strategics” are, 2) determine what their acquisition strategies have been, and 3) be able to explain why that business should be attractive to a strategic acquirer.

5. Recurring revenue – Recurring revenue is the portion of the revenue that is going to continue in the future. It provides a nice base (ideally a growing base) of revenue on which management can rely while focusing on ways to grow the business. It’s especially valuable because the cost of acquiring a new customer is typically about six times the cost of keeping an existing customer.

In consumer products recurring revenue comes from repeat purchase. Maybe you bought the product once because you liked the packaging. You buy it again because the product performed. It’s not enough, of course, to look to recurring revenue; the question is how frequently that revenue will recur. At a prior firm, we invested in a shampoo company with a beautifully designed bottle (it won multiple awards) that dispensed shampoo in the exact proportions the average woman needed. The problem was that the average person usually uses a lot more shampoo than is needed. As a result, consumers took 12-18 months longer than normal to use up our shampoo. Sounds great for the consumer, but it was problematic for the company because it delayed the repeat purchase cycle.

This list is not intended to be all-inclusive; it does include steps, however, that should definitely be considered when evaluating an investment in most small businesses.

Source : Ryan Caldbeck, Contributor, 2012, www.forbes.com

Wednesday, September 23, 2015

The first step in finding the right franchise system is to look inward--to determine what you really want from this investment and the qualities you seek in a franchisor that will help you attain the lifestyle you desire. This includes making a list of your goals and categorizing them into "wish to have" and "must have" lists.

The business may seem sexy, the products or services cool, the customers enjoyable, the business model resilient, and you fit in well. But if the franchise opportunity won't deliver your desired results with a high degree of probability, it is the wrong franchise for you.

Below are six steps for researching and comparing franchise opportunities against their ability to deliver your "must have" and "wish to have" goals. The criteria you will use to compare and contrast businesses, regardless of whether they are in the same industry, are their ability to deliver your desired lifestyle.

Step 1: The Initial Interview

The first interview and presentation of the franchise concept is most likely conducted by telephone and sometimes in person with a franchise sales representative. This is a "getting to know each other" step, where you help the franchise sales representative understand who you are, what makes you successful, and what you are looking to accomplish. The franchise sales representative in turn helps you understand who the franchisor is, what makes the franchise opportunity unique and who makes a successful franchisee. You both begin the process of determining whether your skills and aptitudes match the skills and aptitudes required to succeed within the franchise.

The first interview and presentation of the franchise concept is most likely conducted by telephone and sometimes in person with a franchise sales representative. This is a "getting to know each other" step, where you help the franchise sales representative understand who you are, what makes you successful, and what you are looking to accomplish. The franchise sales representative in turn helps you understand who the franchisor is, what makes the franchise opportunity unique and who makes a successful franchisee. You both begin the process of determining whether your skills and aptitudes match the skills and aptitudes required to succeed within the franchise.

Step 2: Qualification

At this stage, the franchisor will seek to gather and offer more specific details, including whether you have the financial capital to undertake this business opportunity. The purpose is to determine if there is a fit from the franchisor's perspective. This interview may be conducted by telephone or in person, if the franchisor has a sales representative local to you. If you create an open and honest dialogue with the franchise rep, he or she will probably see the potential fit before you do because an insider's perspective on what it takes to win in the system.

At this stage, the franchisor will seek to gather and offer more specific details, including whether you have the financial capital to undertake this business opportunity. The purpose is to determine if there is a fit from the franchisor's perspective. This interview may be conducted by telephone or in person, if the franchisor has a sales representative local to you. If you create an open and honest dialogue with the franchise rep, he or she will probably see the potential fit before you do because an insider's perspective on what it takes to win in the system.

Step 3: FDD and Franchise Agreements Review

Most buyers at this phase conduct a business review of the terms and conditions of the FDD (Franchise Disclosure Document) and make sure you and the franchisor are in agreement on all major points. The FDD is a document the FTC mandates each franchisor to offer franchise candidates. Some states may require additional disclosure information in the FDD.

Most buyers at this phase conduct a business review of the terms and conditions of the FDD (Franchise Disclosure Document) and make sure you and the franchisor are in agreement on all major points. The FDD is a document the FTC mandates each franchisor to offer franchise candidates. Some states may require additional disclosure information in the FDD.

There are two ways to look at a FDD. The first is from a business perspective. Does the disclosure make sense? Can you live with the terms and commitments of the agreement? The second perspective is legal. You can bring the FDD to an attorney, though at this data-gathering stage, that might be premature and an unnecessary expensive. Once you have established the fit, then it will be time to conduct a legal review.

However, now is the time to become aware of what the business commitments look like and whether you are willing to honor those commitments. If for whatever reason there are commitments or obligations in the franchise agreement you can't live with, end the process here. If you can honor these commitments with integrity, proceed to the next step.

Step 4: Franchisee Research

Once you've made it this far, now is time to interview franchisees, gather data, compare the information you receive from franchisees with what you received from the franchisor, and determine whether you will produce your desired results with a high degree of probability.

Once you've made it this far, now is time to interview franchisees, gather data, compare the information you receive from franchisees with what you received from the franchisor, and determine whether you will produce your desired results with a high degree of probability.

Ideally, this is a period of intense data gathering and heavy analysis. Here is where you test the veracity of the franchisor's systems and determine whether the franchisor is skilled and has a profitable business model positioned for the long haul. If the franchise appears to produce your desired lifestyle with a high degree of probability, it's time to invest in professional advice. You need to have a franchise attorney review your FDD and an accountant review your business plan.

Step 5: Visiting the Franchisor's Home Office

Never do business with people you have not met. Franchising at its best is a highly personal relationship. You are entrusting your dreams and capital to the care of the franchisor leadership. Decisions made on the executive level have an impact on whether you'll be able to meet your personal objectives. Go to the corporate offices, meet the decision makers, shake their hands, look them in the eye, and ask tough questions. You have already evaluated the business model against its ability to produce your desired results. Now it's time to evaluate your trust level of the franchisor's leadership and key management.

Never do business with people you have not met. Franchising at its best is a highly personal relationship. You are entrusting your dreams and capital to the care of the franchisor leadership. Decisions made on the executive level have an impact on whether you'll be able to meet your personal objectives. Go to the corporate offices, meet the decision makers, shake their hands, look them in the eye, and ask tough questions. You have already evaluated the business model against its ability to produce your desired results. Now it's time to evaluate your trust level of the franchisor's leadership and key management.

Step 6: The Yes/No Decision

It's time to make up your mind about whether you design a new life and career of your choosing or to go back to the way it was.

It's time to make up your mind about whether you design a new life and career of your choosing or to go back to the way it was.

Source : Joe Matthews, Don debolt & Deb Percival, Contributors, 2011, www.entrepreneur.com

Subscribe to:

Posts (Atom)

Search

Powered by Helplogger

Popular Posts

-

"What is this Nurture Growth Conference about?", you ask. There are so many seminars about Getting Wealthy by the age of 30, or ...

-

As consumer companies continue to expand their global presence, they face a host of formidable challenges: among them, staying clos...

-

In the past few years, the business focus on entrepreneurship and start ups has increased. What exactly does it take to be an entrepren...

-

In 2011, Lavinie Thiruchelvam (a law graduate who worked at ABN Amro and founded Dance Space) started Babydash with her friend from se...

-

Warren Buffet Research and anecdote teaches that wealthy people, including the very wealthiest, are surprisingly frugal. That’s not sa...

-

It was easy to forget about the difficulties of building my business, Brooklyn Taco Co., when I was catering for The Daily Show with ...

-

Not all billionaires and celebrities are obsessed with simply parading their talent or luxurious lifestyle. There are plenty of examples f...

-

Respected and known as one of the strongest independent agencies in the Malaysia ad scene, design, technology and innovation agency VLT h...

-

To answer this question you need to stop thinking like a small business owner and start thinking that you are running a multi-million doll...

Blog Archive

-

▼

2015

(71)

-

▼

September

(23)

- 6 Gorgeous Content Marketing Ideas for Small Business

- Business Analytics 101 – Budgeting, Planning and F...

- Time Management 101: Stop Managing Time

- The Independents: VLT by Warren Tan

- 5 Essentials of Small Business Investing

- Sizing Up a Franchise in Six Steps

- How to Read and Understand a Cap Table?

- How to Manage Time With 10 Tips That Work

- VIDEO: The #Blogging Business with #TimothyTiah, C...

- How Do you Analyze Your #Website Audience In #Goog...

- 5 Ways #Entrepreneurs Screw up the #Hiring Process

- #Financing and Managing Your #Event – The Must Knows

- 30 #TimeManagement Tips For #Work-Life Balance

- What makes #JoelNeoh of #Groupon tick?

- Importance of #Sales & #Marketing

- The 4 Types of Mentors You Need in Your Life to Su...

- Drafting Your #Budget

- 10 Simple Productivity Tips for Organizing Your Wo...

- Entrepreneur Interview: Alex Tsigutkin, Founder An...

- Market to the Best Leads

- How Good is Your #TimeManagement?

- 6 Tips to Hire THE BEST Start-up Leadership

- 10 Ways to Finance Your Business

-

▼

September

(23)

About Best Events

Powered by Blogger.